wealthfront vs betterment tax loss harvesting

Heres the differences between two of the leading options. If you have the cash Wealthfront has a definite.

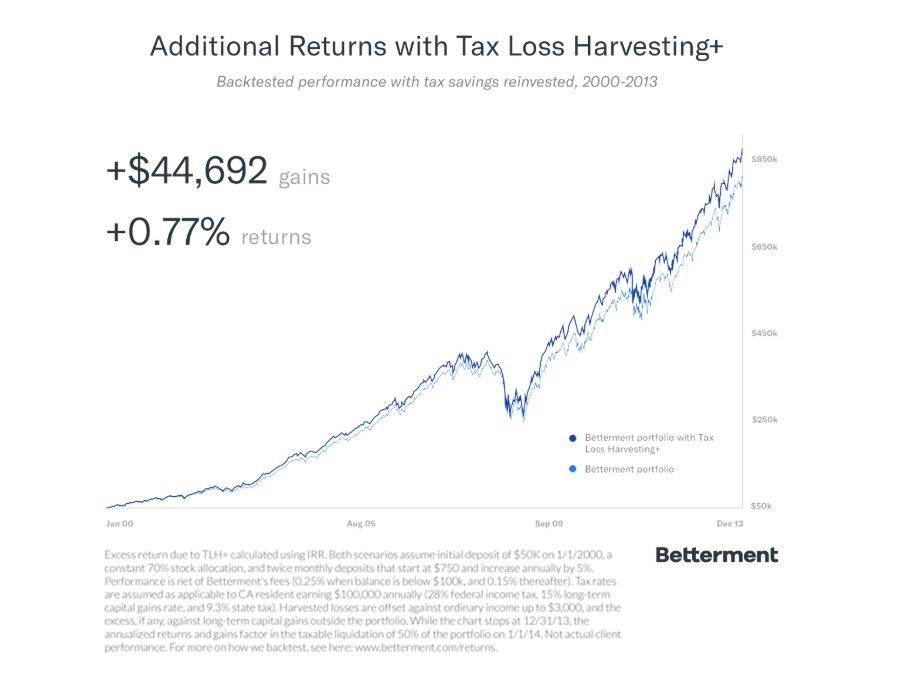

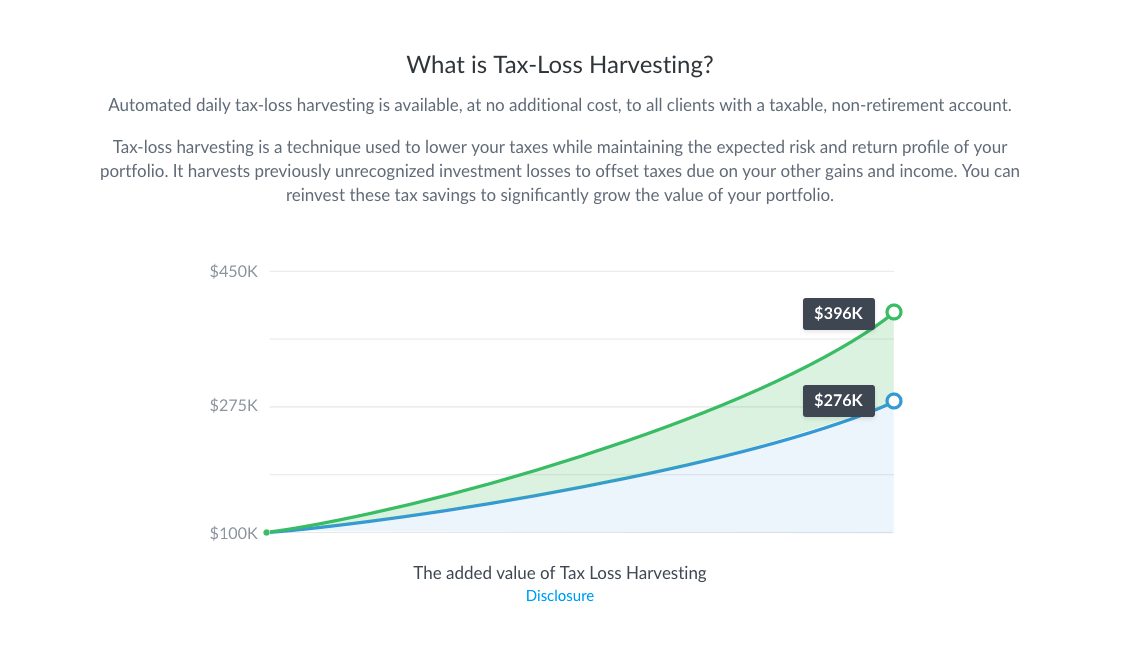

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Their methods for tax harvesting.

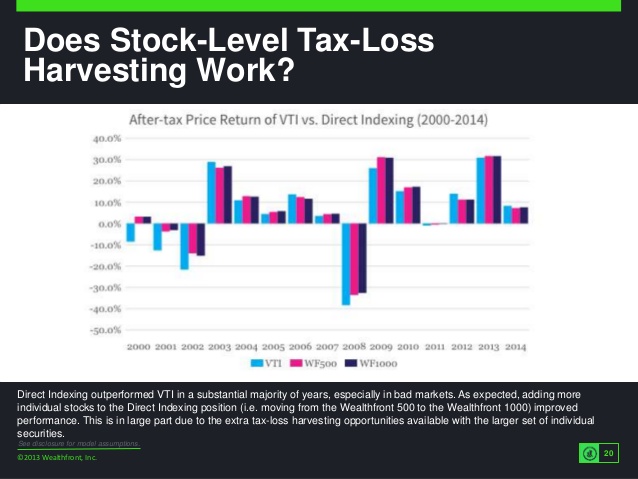

. Unlike Betterment Wealthfront uses stock-level tax-loss harvesting to invest directly in the SP 500 and not just ETFs. This is unique among robo advisors and they recently found that their Tax-Loss Harvesting service. Is it worth trying to accomplish oneself.

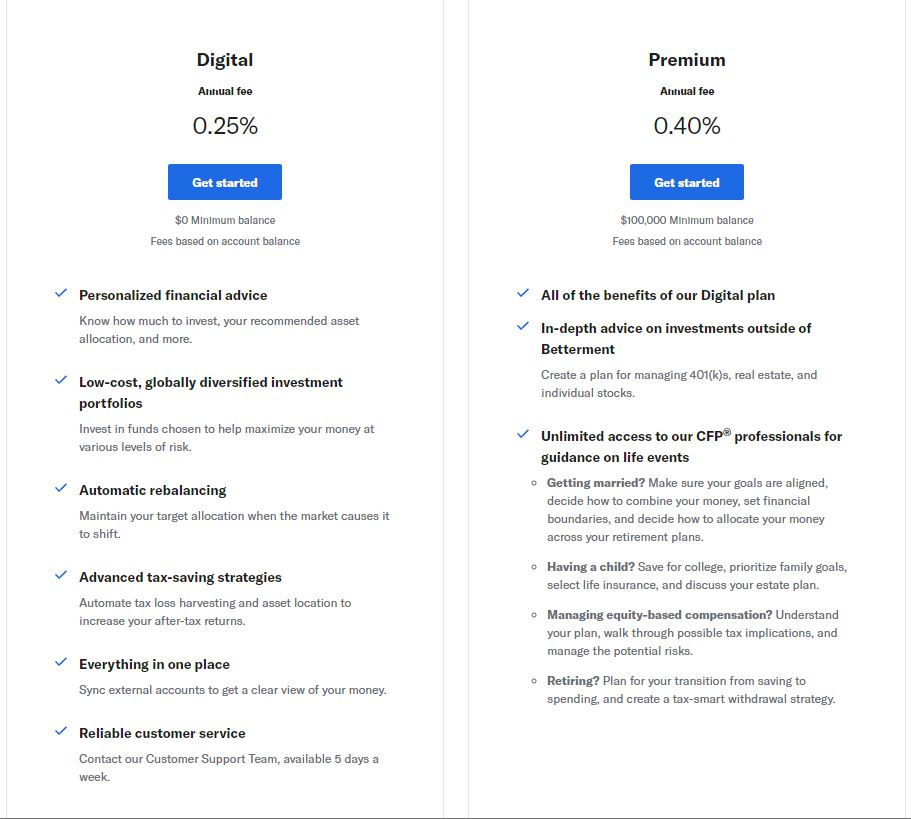

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Also every year Wealthfront publishes the results of its tax-loss harvesting. Betterment and Wealthfront both charge an annual fee of 025 for digital portfolio management.

By providing tax loss harvesting at the stock level. Wealthfront and Betterment both have frequent automated tax-loss harvesting to gain the greatest financial benefit from the strategy. Wealthfront stands out in the robo-advising world because they offer daily tax-loss harvesting on accounts.

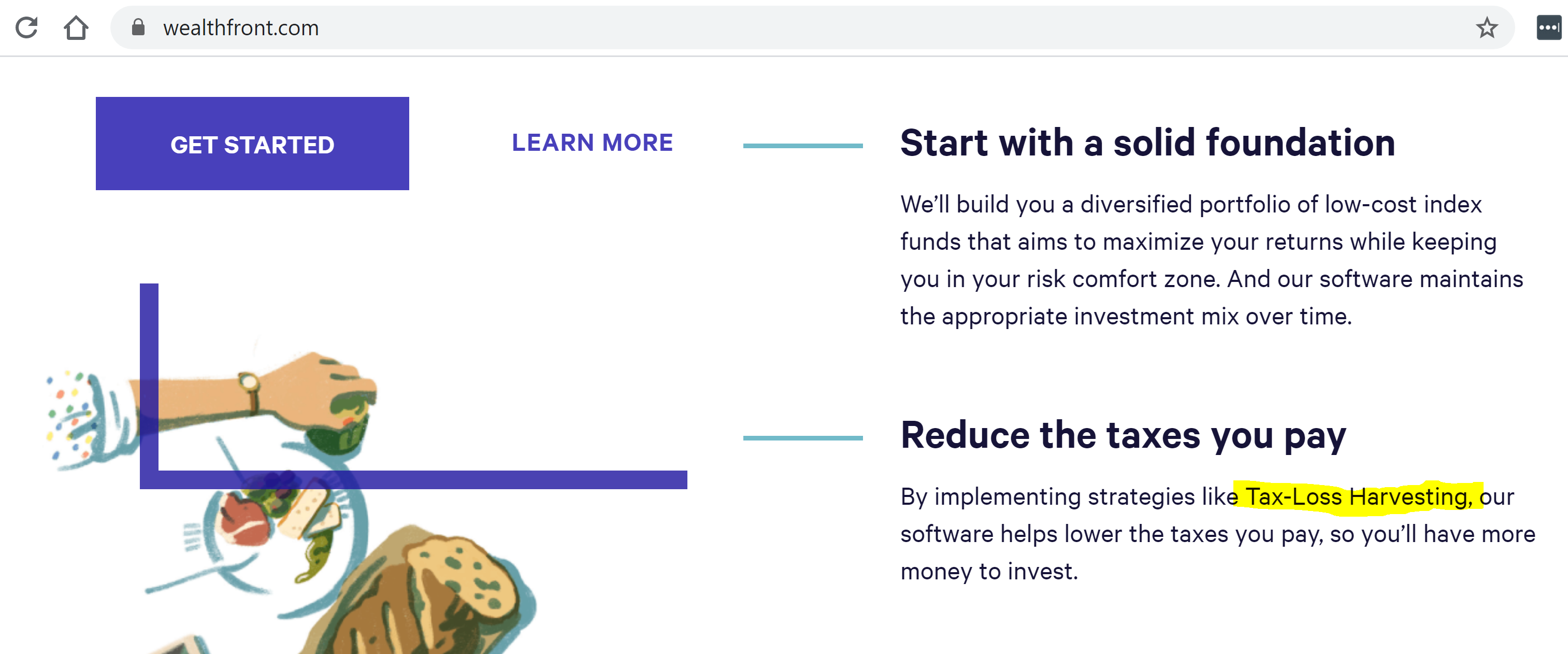

Both Betterment and Wealthfront enable tax-advantaged investing through tax-loss harvesting. Betterment vs Wealthfront Tax-loss Harvesting. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

Wealthfront doesnt have a premium account like Betterment but it does offer additional features for higher account balances such a stock-level tax-loss harvesting for. Fidelity Investments Winner. Betterment provides tax loss harvesting at the index fund level but Wealthfront delivers more for those with more than 500K invested.

Best of all if you sell more losses than gains you can carry those forward to the following tax year. Im curious about tax loss harvesting for the casual investor who doesnt want to spend too much time on it. Wealthfront does have a distinct advantage over Betterment because it.

Tax-loss harvesting means selling losers to take a tax loss that can offset gains. They claim this generates more savings over other robo-advisors who. Portfolio Management Fees.

Higher net worth clients should look to Betterment especially for amounts over 2000000 at which point Betterment fees quickly become a lot. Tax-Loss Harvesting is a strategy that takes advantage of movements in the markets to capture investment losses which can reduce your tax bill leaving. Not all robo-advisors offer the same services and accounts.

The stock-level tax-loss harvesting and risk parity strategies require a minimum account balance of 100000. If I look at the value prop for Betterment or Wealthfront it seems that I can achieve all of the benefits of their service through Vanguard using Admiral Total Market funds except for tax. Here again the two digital investment.

Wealthfront believes that their daily tax-loss harvesting is more beneficial than the TLH offered less-frequently by competitors. The strategy configures costs value and diversification in a different way than Betterments. Or if a robo.

For folks with experience. Wealthfront avails tax loss Harvesting using your losses to offset taxes that would be levied on your gains to everyone using their platform providing benefits to all users alike. TurboTax customers can easily import tax-loss harvesting data from.

PFI SmartAssetLike Betterment Wealthfront also offers. Betterment and Wealthfront both use daily tax-loss harvesting to try to maximize your gains.

Betterment Review 2022 Good Things Investing Robo Advisors

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Tax Loss Harvesting Is Overrated Frugal Professor

Calculating The True Benefits Of Tax Loss Harvesting Tlh

![]()

Getting Tired Of Managing Your Investments Take A Deep Dive And Learn About The Wealthfront Secret Sauce Get The Investing Financial Tips Personal Finance

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Betterment And Wealthfront Are The Robos To Watch In The Battle Against Incumbents See How Their Strat Robo Advisors Good Things Individual Retirement Account

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Should I Use Wealthfront Or Vanguard To Build My Investment Portfolio

Which Is Better For Investing Betterment Vs Wealthfront Gobankingrates

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Should I Use Wealthfront Or Vanguard To Build My Investment Portfolio

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance